travelling allowance exemption malaysia

Petrol allowance travelling allowance or toll payment or any of its combination for official duties. Income of a non-resident from an employment in Malaysia is exempt.

Everything You Need To Know About Running Payroll In Malaysia

Please note that the exemption is applicable for years.

. Income tax allowances and deductionsSpecial allowances and deductions available for an employee transport allowance of Rs 1600 per month are exempt from tax for an employee. Records pertaining to the claim for official duties and the exempted. Meal allowance received on a regular basis.

Total amount paid by employer. Tax exempt as long the amount is not unreasonable. Below are some examples of perquisites.

Tax exempt up to RM2400 per year. Exemption amount of 70 of such allowance or 10000 per month whichever is. Salary bonuses allowancesbenefits Tax benefits for foreign workers in Malaysia expatriates.

Any amount received more than Rs1600 is taxable. Records pertaining to the claim for official duties and the exempted amount must be kept for a period of seven years for audit. EXEMPTION LIMIT PER YEAR 1.

Find out the scale rate expenses for accommodation and subsistence paid to employees who travel outside of the UK. Exemption available up to RM6000 per annum if the allowancesperquisites are for official duties Childcare subsidies allowances. If the amount received exceeds RM6000 a year the employee can make a further deduction in respect of the amount spent for official duties.

Tax exempt up to RM6000 per year. Exemption available up to RM2400 per annum. Petrol cardpetrol or travel allowances and toll rates.

If the travel allowance paid is less than RM2400 a year then the exemption is the actual amount of travel allowance paid. Statutory earnings refer not only to your monthly salary but also to commissions bonuses allowances benefits. The exemption is effective from year of assessment 2008 to year of assessment 2010.

Petrol card petrol or travel allowances and toll rates. Exemption up to RM6000 per year if the allowancesbenefits are for official duties A benefit is a benefit or benefit provided to you by your employer such as travel allowances and medical allowances. Transport allowance for employees of transport business for covering personal expenditure during the running of such transport.

Exemption available up to RM6000 per annum if the allowancesperquisites are for official duties. Includes payment by the employer directly to the parking operator. Exemption available up to RM6000 per year if allowancesbenefits are intended for official functions Cash compensation eB.

3200 per month. Petrol allowance petrol card travelling allowance or toll payment or any combination. If the amount exceeds RM6000 further deductions can be made in respect of the amount spent for official duties.

Fuelgas card or travel allowances and toll rates Hello if my employer gives me an allowance for my car loan and apartment is it tax-free. Includes payment by the employer directly to the childcare provider. Here are some examples of benefits.

A perquisite is a perk or benefit given to you by your employer like travel and medical allowances. Transport allowance to commute from place of residence to place of dutyoffice for physically challenged employees. Travelling allowance or petrol allowance received by an employee for travelling from home to place of work and from place of work to home is exempted up to an amount of RM2400 per year.

Petrol allowance travelling allowance or toll payment or any of its combination for official duties. Total amount paid by employer. Parking allowance including parking rate paid by the employer directly.

If the amount received exceeds RM6000 a year the employee can make a further deduction in respect of the amount spent for official duties. There are many types of allowances officially confirmed by LHDN as a tax-exempt allowance LHDN Inland Revenue Board of Malaysia. Total amount paid by employer.

Petrol travel toll allowances. You are given a tax exemption of up to RM2400 a year if your employer pays you a travel allowance that means this benefit will not be declared in your tax return. Allowances 321 Travelling allowance petrol allowance or toll rate i.

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Bdo Malaysia The Covid 19 Outbreak Has Without A Doubt Impacted The Global And Malaysian Economic Scene In Light Of This The Government Has Announced The 2020 Economic Stimulus Package With The

Everything You Need To Know About Running Payroll In Malaysia

Personal Tax Relief 2021 L Co Accountants

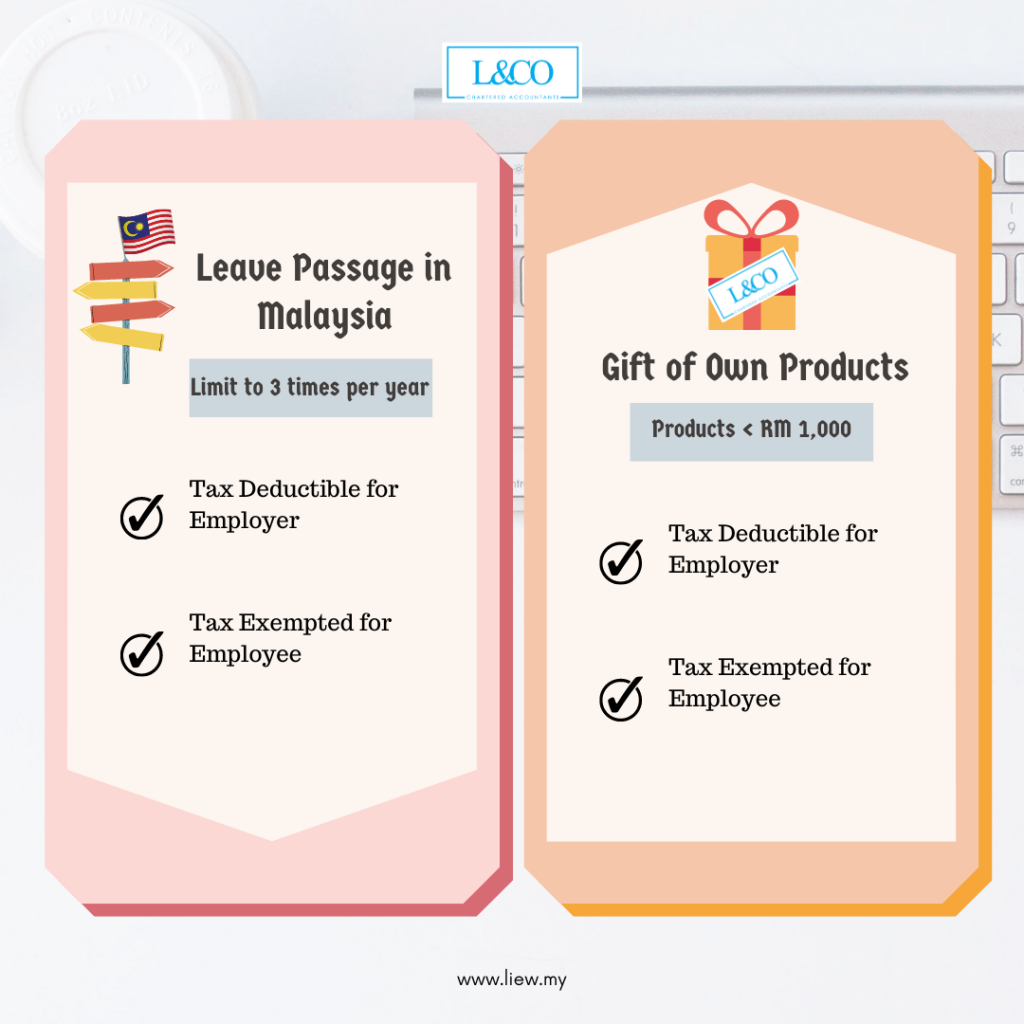

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Individual Income Tax In Malaysia For Expatriates

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Identification Of Barriers And Challenges Faced By Construction Key Players In Implementing The Green Building Incentives In Malaysia Emerald Insight

Updated Guide On Donations And Gifts Tax Deductions

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Which Benefits Are Tax Exempt For Employees In Malaysia Ya 2021 Althr Blog

What Type Of Income Can Be Exempted From Income Tax In Malaysia

Comments

Post a Comment